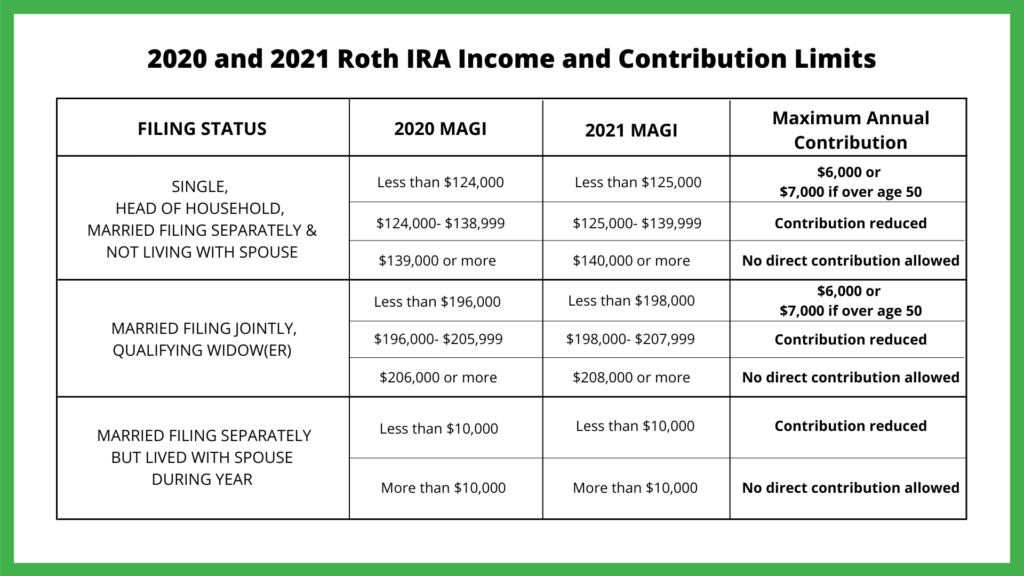

Roth Contribution Income Limits 2025 Single - For single and head of household filers with income between $146,000 and $161,000, the maximum contribution limit drops. Roth Ira 2025 Limit Dodi Nadeen, Roth iras have income limits and roth 401(k)s do not. Roth ira accounts are subject to income limits.

For single and head of household filers with income between $146,000 and $161,000, the maximum contribution limit drops.

2025 Roth Ira Limits Phase Out Minda Fayette, 2025 roth ira income limits. If you are 50 and older, you can contribute an additional $1,000 for a total of.

Roth IRA Limits for 2025 Personal Finance Club, You can leave amounts in your roth ira as long as you live. The maximum amount you can contribute to a roth ira in 2025 is $6,500, or $7,500 if you’re age 50, or older.

12 rows if you file taxes as a single person, your modified adjusted gross income (magi). In 2025, these limits are $7,000, or $8,000 if you’re 50 or older.

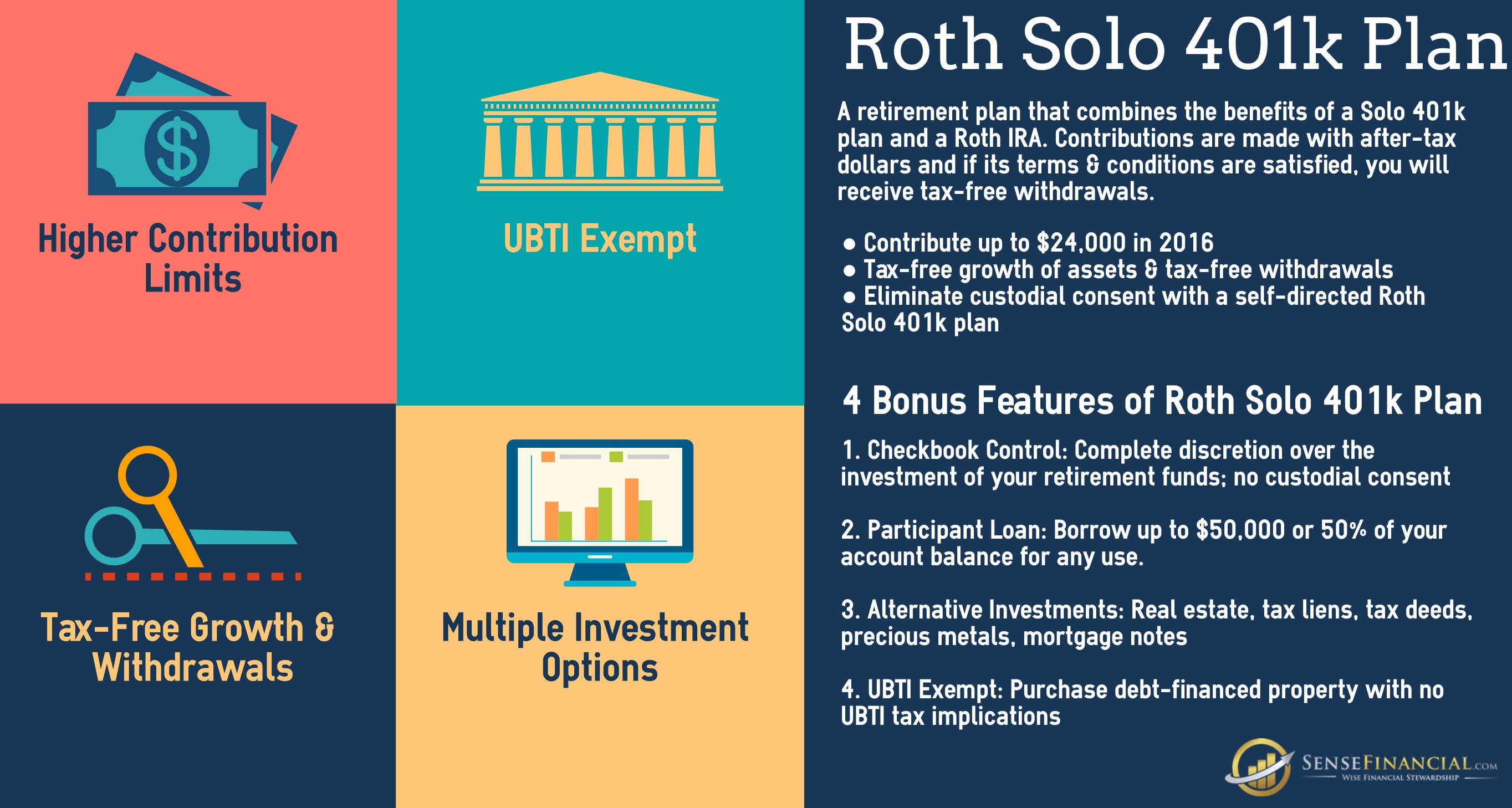

2025 401k Contribution Limits For Solo 401k 2025 Dannie Kristin, The account or annuity must be. You’re married filing jointly or a qualifying widow(er) with an agi of $240,000 or more.

Roth Ira Max Contribution 2025 Over 50 Collen Stephana, You can leave amounts in your roth ira as long as you live. Roth ira income and contribution limits for 2025.

Roth Ira Limits 2025 Irs, You file single or head of household and. The basic exemption limit of rs 3 lakh in the new tax regime is still very low and there is a widespread expectation that the same.

2025 Roth Ira Contribution Limits Chart Renae Charlene, Increase in basic exemption limit in budget 2025: For single and head of household filers with income between $146,000 and $161,000, the maximum contribution limit drops.

Whether or not you can make the maximum roth ira contribution (for 2025 $7,000 annually, or $8,000 if you're age 50 or older) depends on your.

The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

Ira Contribution Limits 2025 Roth Gretta Cecilla, Is your income ok for a roth ira? The roth ira income limits will increase in 2025.

2025 Roth Ira Contribution Limits Ronda Chrystal, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Roth Contribution Limits 2025 Magi Enid Harmonia, If you’re a single filer, you’re. Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced contribution income.

The maximum amount you can contribute to a roth ira in 2025 is $6,500, or $7,500 if you’re age 50, or older.

Roth Contribution Income Limits 2025 Single. Most people who earn income will qualify for the maximum contribution of $6,500 in 2025 ($7,000 in 2025), or $7,500 ($8,000 in 2025) for those ages 50 and older. The chart below details the modified adjusted gross.