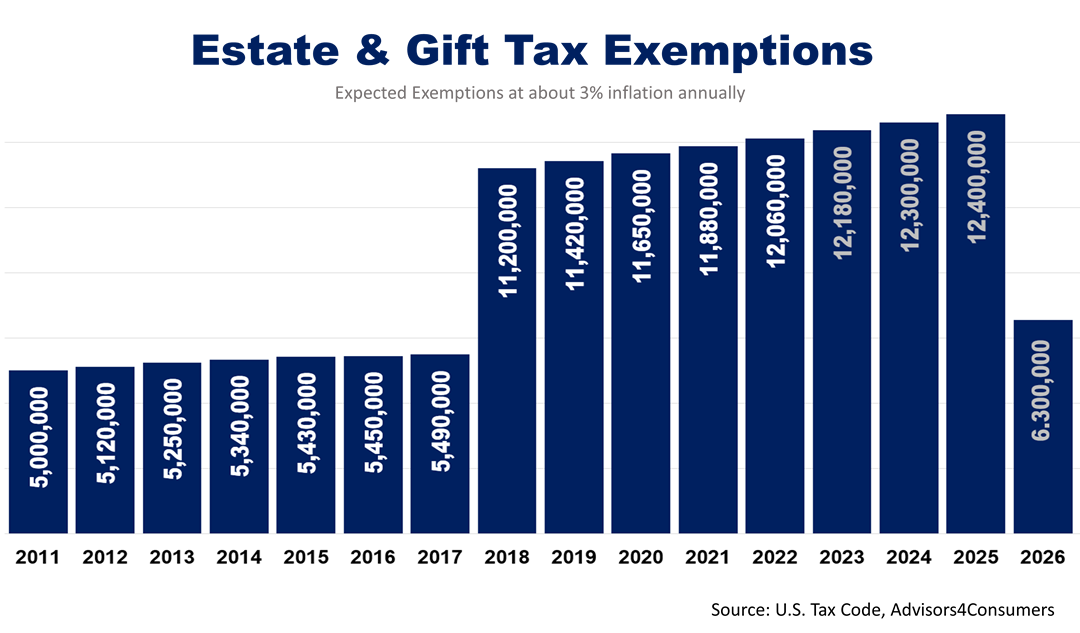

What Is The Amount You Can Gift In 2025 - IRS Gift Limit 2025 Check the Gift Amount, You Can Give Without Paying Tax, Gift tax limits for 2022. The 2025 gift tax limit is $18,000, up from $17,000 in 2025. IRS Increases Gift and Estate Tax Thresholds for 2025, This is known as the annual gift tax exclusion. Starting on january 1, 2025, the annual exclusion on gifts will be $18,000 per recipient (up from.

IRS Gift Limit 2025 Check the Gift Amount, You Can Give Without Paying Tax, Gift tax limits for 2022. The 2025 gift tax limit is $18,000, up from $17,000 in 2025.

What Is The Amount You Can Gift In 2025. The internal revenue service (irs) has increased the exemption amounts for the federal gift tax and estate tax to the highest amounts they have ever been. This limit is adjusted each year.

But even if you exceed that amount, there are some. In 2025, taxpayers can gift up to $18,000 to a person without reporting it to the irs on a federal gift tax return.

How Much Money You Can Gift To A Family Member Tax Free YouTube, The gift tax is imposed by the irs if you transfer. Starting on january 1, 2025, the annual exclusion on gifts will be $18,000 per recipient (up from.

Gifting Money To Your Siblings Tax Free Rules And Regulations, Such gifts are subject to a. The annual exclusion applies to gifts to each donee.

The gift tax is imposed by the irs if you transfer.

Fortnite VBucks Gift Cards Where to redeem and buy them including, The tax treatment is automatic—you don‘t even have to file a gift tax. The irs typically adjusts this gift tax exclusion each year based on inflation.

In other words, if you give each of your children $18,000 in 2025, the annual exclusion applies to each gift.

Employee Appreciation Day 2025 Activities For Kids Tandi Florella, For example, you only have to file a gift tax return if you give more. Such gifts are subject to a.

How Much Should You Spend on a Wedding Gift? HuffPost Life, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.). The $18,000 amount is how much each person can give to any other person each year without the gift being treated as a taxable gift.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, In addition, the estate and gift tax exemption will be $13.61 million per individual for 2025 gifts and deaths, up from $12.92 million in 2025. For a married couple, the exclusion.

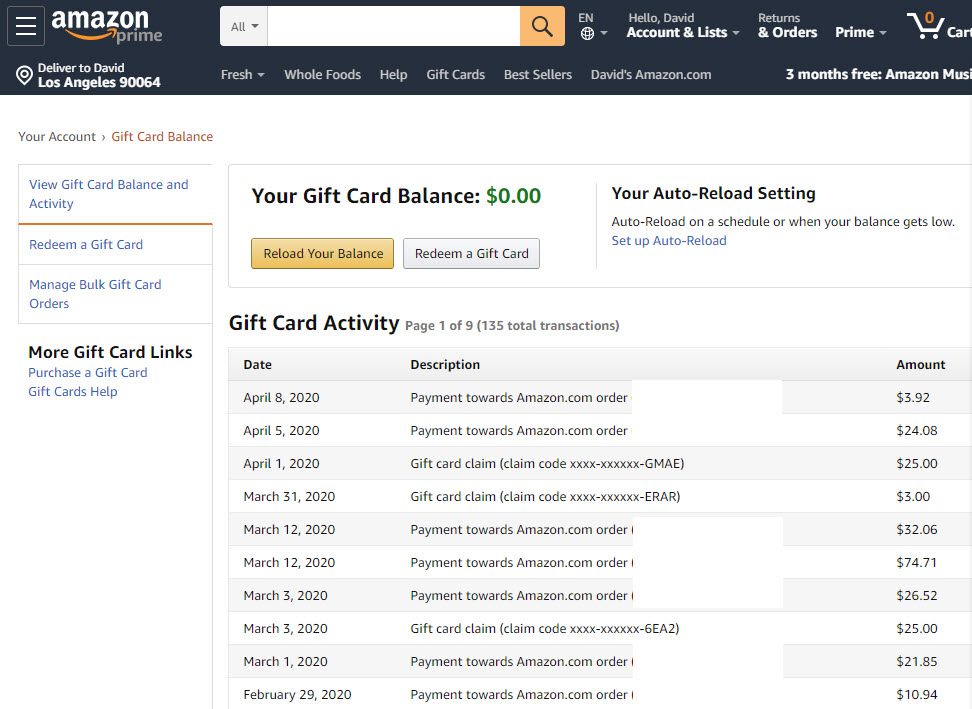

E Swag Corp Amazon Com Login, Starting on january 1, 2025, the annual exclusion on gifts will be $18,000 per recipient (up from. But even if you exceed that amount, there are some.

After giving out money or property exceeding the lifetime threshold, your gift tax rate will be between 18 percent and 40 percent, depending on how far your cumulative gifts eclipse it.

The irs typically adjusts this gift tax exclusion each year based on inflation.

ACG product ALIS News 2022 Estate & Gift Tax Planning For Large, For example, you only have to file a gift tax return if you give more. This is £3,000 in total, so if you’re looking to give a cash gift to multiple people.